Donate to Warwickshire Young Carers

Can you support us to ensure that young carers across Warwickshire have access to a break from their caring role?

£10 - Is the cost of a young carer receiving an activity pack through the post.

£20 - Could fund a young carer attending a trip or activity.

£30 - Could help to cover the cost of transporting an isolated young carer to and from a group or activity.

£50 - Could help to fund a young carer accessing one targeted support session from an allocated specialist young carers support worker.

£75 - Could contribute to funding a place for a young carer on a 3 night residential.

£100 - Could fund the cost of an external professional delivering an activity to a group of 6-8 young carers, such as yoga, a poetry workshop or a therapeutic baking session.

Donate now >

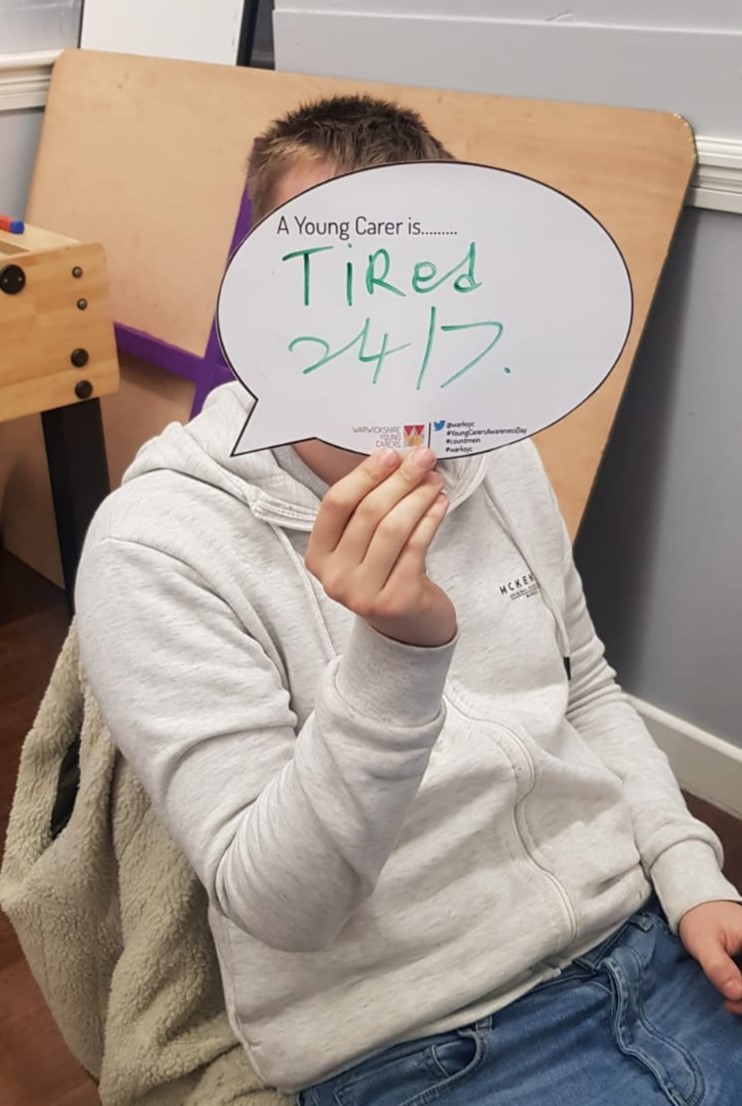

Want to know more about who young carers are or how our support makes a difference to the lives of young carers and their families?

Some of our young carers and their families share their experiences in the video below.

Donate now >

Turn the work you do into good

Your small business can have a powerful and positive impact, whatever your size. Please support Warwickshire Young Carers through your sales in a simple, sustainable and legal way, via our Work for Good page here